2022 tax brackets

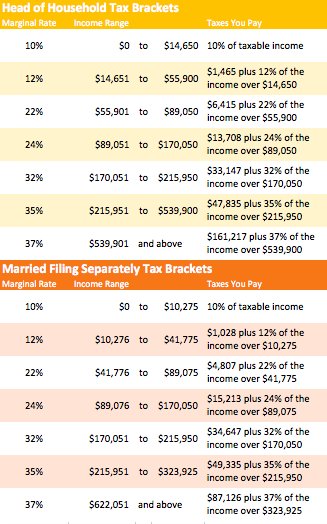

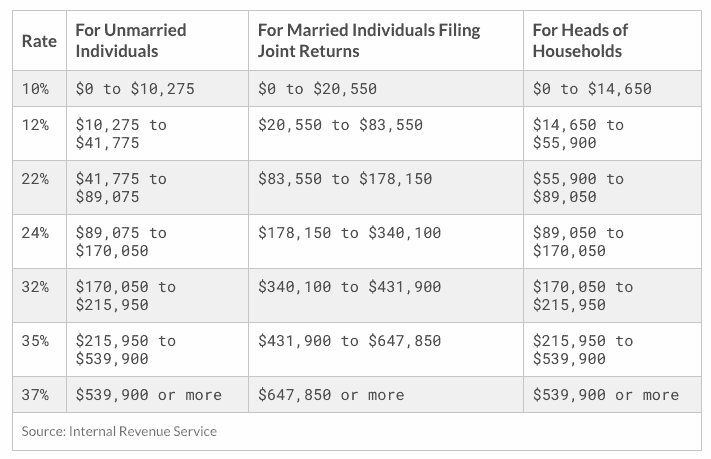

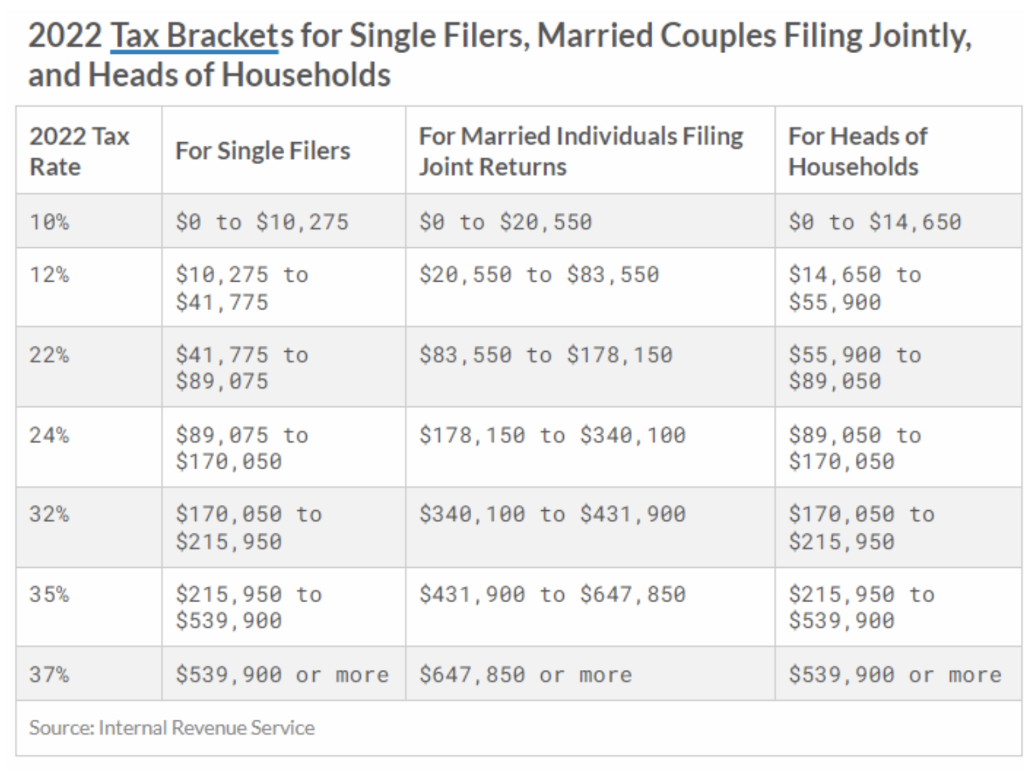

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 2023 Federal Income Tax Bracket s and Rates.

What Are The Income Tax Brackets For 2022 Vs 2021

The current tax year is from 6 April 2022 to 5 April 2023.

. 1 day agoTax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to inflation. 2022 New Jersey Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Heres what filers need to know.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends. 2021 federal income tax brackets for taxes due in April 2022 or in. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals.

Compare your take home after tax and estimate. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

Here are the 2022 Federal tax brackets. The IRS on Nov. Federal Income Tax Brackets for 2022 Tax Season.

9 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. There are seven federal income tax rates in 2022. Steffen noted that a married couple earning 200000 in both.

And the alternative minimum tax exemption amount for next. Each of the tax brackets income ranges jumped about 7 from last years numbers. A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable.

Income Tax rates and bands. Americas tax brackets are changing thanks to inflation. 16 hours agoThe IRS has released higher federal tax brackets and standard deductions for 2023 to adjust for inflation.

Download the free 2022 tax bracket pdf. Up from 25900 in 2022. 10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension.

There are seven tax brackets for. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. 2022 tax brackets are here.

11 hours ago2022 tax brackets for individuals. The 2022 tax brackets affect the taxes that will be filed in 2023. 15 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022 to. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 12 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. The income brackets though are adjusted slightly for inflation. Heres a breakdown of last years.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of. The agency says that the Earned Income. From 6935 for the 2022 tax year to 7430 in 2023.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

Tax Changes For 2022 Including Tax Brackets Acorns

How Do Tax Brackets Work And How Can I Find My Taxable Income

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Tax Brackets For 2021 2022 Federal Income Tax Rates

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 Tax Brackets Internal Revenue Code Simplified

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/GWKXS3YGARBDJGDOGWQTVI7Y64.jpg)

2021 2022 Federal Income Tax Brackets And Standard Deductions The Dough Roller

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

2022 2023 Tax Brackets Rates For Each Income Level

2022 Income Tax Brackets Darrow Wealth Management

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Understanding Marginal Income Tax Brackets The Wealth Technology Group

1 1pt Assume You Are A Single Individual With Chegg Com

What S My 2022 Tax Bracket Canby Financial Advisors

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/CDS3MAEWJVCTHB6SLZQ3KZXGMM.jpg)